Tx FHA Mortgage Conditions: The new Tx housing market is certian solid with an increase of to get interest

A great deal more first-time homebuyers inside Dallas, Houston, Austin, San Antonio, are now going into the industry and seeking having financial possibilities one to offer self-reliance and under control terms and conditions. The newest Federal Casing Administration is actually a mortgage insurer that will help basic-time customers rating good home loan with a decreased downpayment. Actually, acknowledged homeowners in Tx can purchase property that have only a small amount since step 3.5% advance payment.

FHA mortgages are funds that will be insured by the FHA so you can provide security on the debtor however if he/she non-payments. Someone can buy such finance regarding the FHA-acknowledged loan providers having flexible terms and conditions into deposit and you may secure repaired rate of interest. Although not, as , new FHA has made a number of modifications to help you their guidelines you to definitely see whether or perhaps not you be eligible for FHA-insured loans.

Your existing credit history and you can records will allow the financial institution so you can features a far greater knowledge of the money you owe. And therefore, it goes without saying that credit rating with quite a few later payments, terrible monetary behavior, and you will delinquency have a tendency to reduce mortgage alternatives that you’re able to to get.

FHA-covered financing that have almost 3.5% down payment are available to candidates that have a credit score of 620 otherwise a lot more than. Having said that; people with straight down fico scores can still getting eligible for FHA home loans however, would be to plan on at the least 5%-10% down-payment amount.

If you are thanks to case of bankruptcy, specific banking institutions and lenders can still approve you to have lenders. In the example of Chapter 13 Personal bankruptcy, the person must show that he’s got produced timely money for around for the last one year. If the recognized, this new applicant should get created recognition from the court trustee and you will must provide an entire cause of their personal bankruptcy and just how it have increased financially having occupations balances.

Generally, a couple traces of your credit rating is actually enough to influence your qualification to possess FHA loans

Individuals who are currently for the A bankruptcy proceeding Bankruptcy proceeding never submit an application for FHA-covered loans. The minimum period you have got to waiting following the date away from launch of brand new Chapter 7 otherwise 13 Case of bankruptcy may differ out of lender to lender, it is basically 24-forty-eight weeks. You may be needed to help make your instance you are in a position to be considered economically which have improving borrowing from the bank and job balances.

Keep in mind that the borrowed funds business will receive an extensive consider your credit report. Anytime your credit score is full of late payments rather than simply several separated circumstances, your chances of taking beneficial terms would-be limited, and so tend to your own eligibility for some financing. But when you was indeed capable manage an effective costs immediately following financial hardships then you can be eligible for FHA fund.

Your credit rating and you will records enjoy a crucial role inside choosing your own qualification regarding a keen FHA-insured loan

- Solitary family unit members house, city house and you may FHA approved condos

- Just step 3.5% downpayment max 96.5% investment

- The home provider pays the new consumers closing costs

- Our home customers down payment are a gift away from relatives, an such like

- This new down-payment also can come from a neighbor hood, condition, condition paid down payment assistance program

- No unique first time customer class needed to apply for an effective FHA financing

- Safe augment price 15, 31 terms and conditions

- Zero very early recapture otherwise pre payment penalty offer and you can flow each time instead of punishment

- Great FHA re-finance solutions however if rates of interest disappear

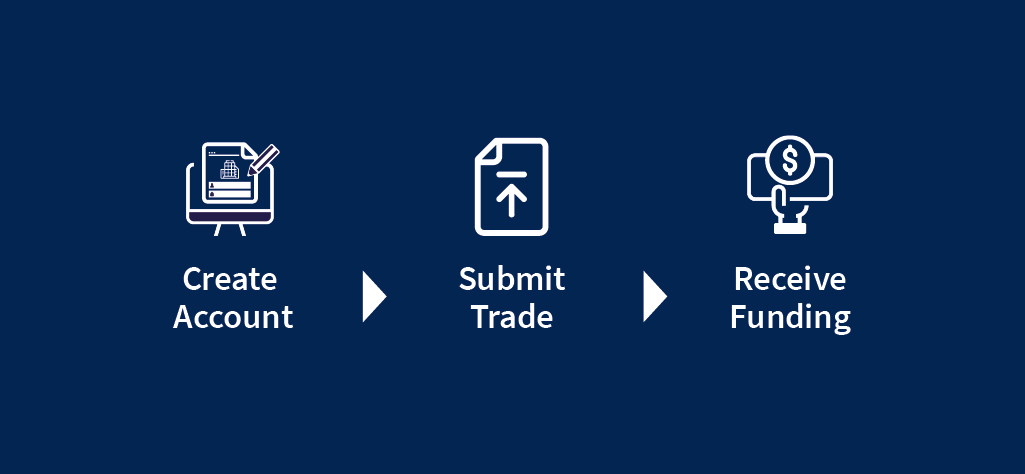

Home buyers that require to learn more can also be call us in the ph: 800-743-7556 having an instant impulse simply fill in the details demand function on the these pages.

Napsat komentář